With the assistance of annuity plans introduced by means of quite a lot of Annuity Provider Suppliers (ASPs) in India, folks can very easily plan for his or her post-retirement existence. For an confident per 30 days source of revenue, folks wish to purchase an annuity plan from any ASP towards a lump sum.

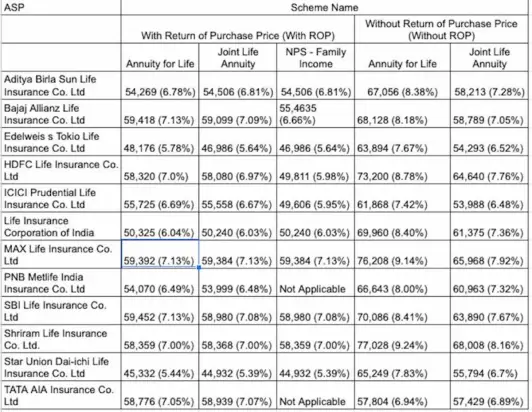

The annuity charges lately introduced by means of quite a lot of ASPs range from as little as 5.44% to as top as 9.24%.

In its ‘Pension Bulletin’ for January 2023, the Pension Fund Regulatory and Construction Authority (PFRDA) shared the quite a lot of annuity charges introduced by means of ASPs in India.

The knowledge displays that for a purchase order value of Rs 1 crore, a person can get a per 30 days pension of Rs 70,086 at 8.41% from SBI Existence Insurance coverage beneath the “Annuity for Existence” with out Go back of Acquire Value plan. Below Annuity for Existence With Go back of Acquire value, SBI existence is providing as much as Rs 59,452 for people and Rs 58,980 monthly for joint existence at a 7.08% fee of go back.

Annuity Charges and Pension Quantity for Rs 1 crore

In a similar fashion, for a lump sum acquire value of Rs 1 crore, a person can get a per 30 days pension of as much as Rs 69,960 at 8.40% fee of go back from LIC of India beneath an Annuity for Existence With out Go back of Acquire Value plan. Below Annuity for Existence With Go back of Acquire value, LIC is providing as much as Rs 50,325 for people and Rs 50,240 monthly for joint existence at 6.03% fee of go back.

On the fee of 9.24%, Shriram Existence Insurance coverage is providing the best fee of returns in comparison to different ASPs beneath “Annuity for Existence” with out the Go back of Acquire Value plan. The bottom fee of go back of five.44% is obtainable by means of Superstar Union Dai-ichi Existence Insurance coverage beneath “Annuity for Existence” with Go back of Acquire Value Plan.

With HDFC Existence Insurance coverage, a person can get a per 30 days pension of Rs 73,200 at 8.78% by means of purchasing an Annuity for Existence With out Go back of Acquire Value Plan for Rs 1 crore. HDFC Existence could also be providing a fee of go back of seven% and Rs 58,320 per 30 days pension beneath Annuity for Existence With Go back of Acquire Value Plan.

(The above content material is for info functions handiest, in line with knowledge in PFRDA’s Pension Bulletin. The charges discussed are as on 27.02.2023. If making plans to shop for an annuity plan, you will have to test the present charges with the ASP and likewise seek the advice of a retirement consultant for very best recommendation.)

Supply By way of https://www.financialexpress.com/cash/lic-to-sbi-how-much-pension-can-you-get-for-rs-1-crore-annuity-rates-of-12-asps-compared/3011079/