In a construction that can assist folks to track their unclaimed deposits mendacity in banks, the Reserve Financial institution of India (RBI) has made up our minds to broaden a internet portal to permit seek throughout more than one banks for conceivable unclaimed deposits.

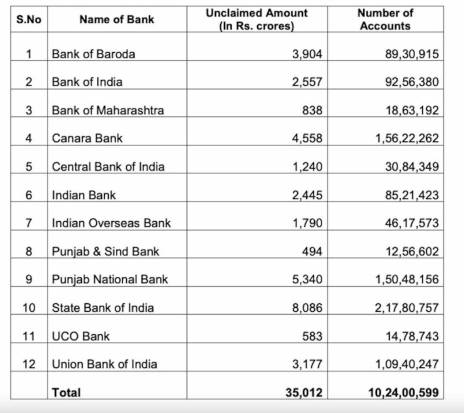

Public Sector Banks (PSBs), together with SBI and PNB, transferred Rs 35,012 crore of unclaimed financial institution deposits to RBI on the finish of February 2023. Those deposits had been mendacity in banks unclaimed for 10 years or extra.

“As in step with data to be had with the Reserve Financial institution of India (RBI), as on the finish of February, 2023, the whole quantity of unclaimed deposits transferred to RBI via Public Sector Banks (PSBs) in appreciate of deposits that have no longer been operated for 10 years or extra, used to be Rs. 35,012 crore,” Dr Bhagwad Karad, Union Minister of State within the Ministry of Finance, mentioned in a written respond to a question within the Lok Sabha on April 3.

Additionally Learn: Excellent information for homebuyers as RBI helps to keep repo charge unchanged

As in step with RBI’s directions, banks are required to make an annual overview of accounts by which there are not any operations for multiple 12 months. Banks might also way shoppers and tell them in writing that there was no operation of their accounts and verify the explanations for a similar.

“Banks have additionally been steered to imagine launching a different force for locating the whereabouts of the purchasers / criminal heirs in appreciate of accounts that have transform inoperative, i.e., the place there are not any transactions within the account over a duration of 2 years,” mentioned Dr Karad.

“Additional, banks are required to show the record of unclaimed deposits/ inoperative accounts that are inactive/inoperative for ten years or extra on their respective internet sites, with the record containing the names and addresses of the account holder(s) in appreciate of unclaimed deposits/ inoperative accounts,” he added.

Additionally Learn: Salaried worker? TDS to be deducted at New Tax Regime charges if you happen to don’t decide out, says CBDT

Financial institution-wise record of unclaimed deposits

the tip of February, 2023

What RBI plans to do

The RBI will arrange a centralised internet portal to permit seek for unclaimed deposits throughout banks. The quest shall be additional augmented with the assistance of Synthetic Intelligence (AI) equipment.

“The deposits ultimate unclaimed for 10 years in a financial institution are transferred to the “Depositor Training and Consciousness” (DEA) Fund maintained via the Reserve Financial institution of India. Depositors’ coverage being an overarching purpose, RBI has been taking quite a lot of measures to make certain that more recent deposits don’t flip unclaimed and present unclaimed deposits are returned to the rightful house owners or beneficiaries after following due process. On the second one facet, banks show the record of unclaimed deposits on their website online,” the RBI mentioned in its “Observation on Developmental and Regulatory Insurance policies” on Thursday (April 6).

“So as to enhance and widen the get right of entry to of depositors/beneficiaries to such knowledge, RBI has made up our minds to broaden a internet portal to permit seek throughout more than one banks for conceivable unclaimed deposits in response to consumer inputs. The quest effects shall be enhanced via use of positive AI equipment,” it added.

Supply By way of https://www.financialexpress.com/cash/sbi-to-pnb-bank-wise-full-list-of-unclaimed-deposits-of-psbs-with-rbi-and-what-it-plans-to-do/3036169/